Affordability remains a pressing concern for Alberta drivers in 2025. This concern has become increasingly apparent from the rising cost of living, whether that be from groceries to gas, inevitable yearly inflation, and the tariff threats from our neighbouring country. While insurance rates change every year to adjust to changes in your driving record, as well as inflation and claim frequency, there has been a spike in auto theft and fraud in the last few years, thereby increasing drivers’ monthly premiums.

The AIRB is aware of these challenges and continues to closely monitor rate changes. Our job is to properly regulate and oversee premium changes, so they accurately reflect the changing trends in claims, costs, and risk. All insurers are held accountable and must justify any proposed increases to the AIRB before approval. This ensures fairness and transparency across the province’s insurance industry. You can see each company’s approved rate filings on our website.

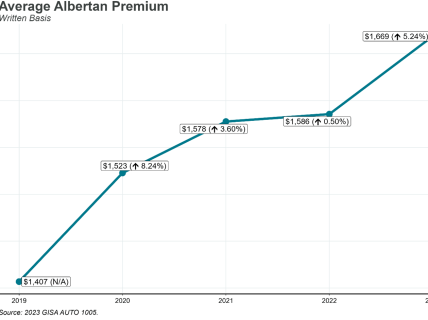

What the numbers are telling us:

There are multiple factors that affect auto insurance premium changes, but some of the main ones shaping the higher rates this year include:

- Rising repair costs: The cost of labour and new vehicle parts has become more expensive due to supply chain issues and inflation. Modern vehicles are also staring to include safer, technologically advanced features, making even minor repairs costlier.

- Increased theft claims: Alberta has the highest per capita rate of stolen vehicles in the country. More auto theft and fraud mean a higher claim frequency. Insurers pass these growing costs onto consumers through higher premiums.

- Inflation: General economic inflation affects every part of the insurance industry from medical treatment costs to legal expenses and claim payouts.

- Increased severity of accidents: While the number of accidents hasn’t dramatically spiked, the severity of claims has increased. This may be tied to distracted driving, more expensive vehicle technology, and rising medical treatment costs.

Regulatory tools at work:

Even though there are many pressures on the auto insurance industry today, there are mechanisms in place to ensure fairness for consumers.

- Good Driver Rate Cap: The Alberta government implemented a 7.5% cap on insurance premium increases for drivers with clean records (5% base increase plus 2.5% due to natural disasters). This is designed to reward safe driving habits and prevent disproportionate premium hikes for low-risk individuals.

- AIRB oversight: The AIRB plays a key role in reviewing and approving all proposed auto insurance rate changes in Alberta. No rate increase can take effect without our approval. We conduct a thorough review of each rate filing to ensure it is actuarially sound and in the public interest. Our goal is to strike a balance between keeping premiums fair and affordable for Albertans, while allowing insurers to cover their costs and continue operating in the province. We closely examine all elements of a filing—such as rating variables, discounts, surcharges, rating models, and how changes are communicated to policyholders. The AIRB also assesses the insurer’s recent financial performance to determine whether past premiums have adequately covered claims and expenses, to monitor for excess profits.

Looking Ahead

Alberta’s government intends to establish reforms to improve the affordability of auto insurance for drivers. The Care-First model, set to launch in 2027, will focus more on improving care and recovery outcomes for accident victims rather than lengthy and costly litigations. With this change, drivers will no longer have to sue to get proper treatment and support after an accident and this will reduce claim costs by eliminating legal fees.

With AIRB safeguards in place and new systems like Care-First on the way, the province is working toward a more balanced and consumer-focused insurance system. Staying informed about the forces at play can help drivers make better decisions and stay safe on the road.

For more information about the Care-First system or auto insurance news, check out our website at airbfordrivers.ca or follow us on our socials @albertaairb.